Withholding Tax Table 2024 Semi Monthly

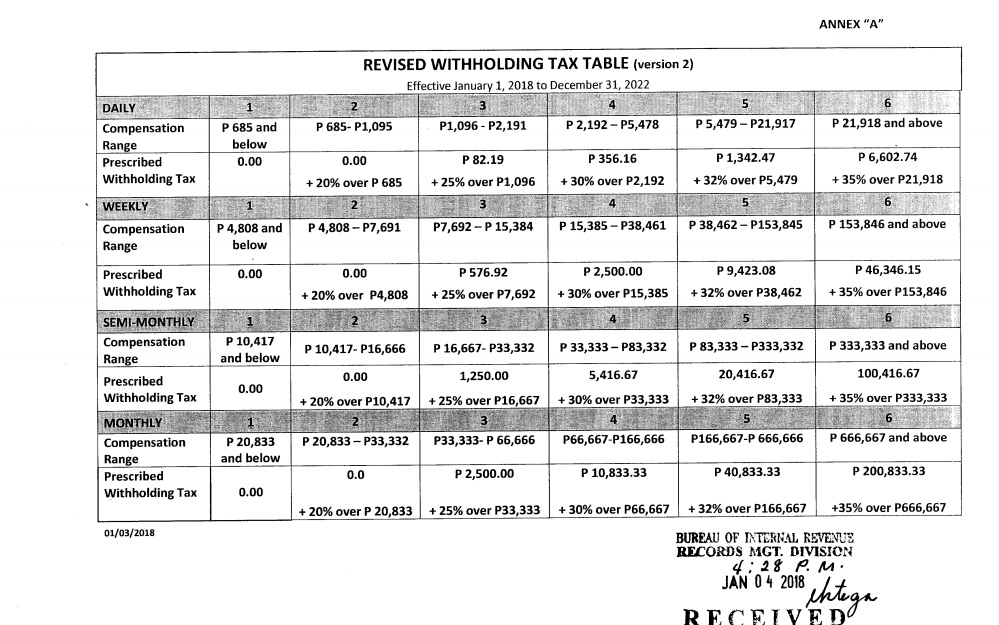

Withholding Tax Table 2024 Semi Monthly. The service posted the draft version of. Stay informed about tax regulations and calculations in philippines in 2024.

Not seeing an interactive table? Second additional cpp contributions (cpp2)

Philippines Tax Calculator 2024 Get Started.

Based on the revised withholding tax table of bir, since this taxable income is above ₱20,833 and below ₱33,332, we subtract ₱20,833 from ₱28,175 to get ₱7,342.

The Social Security Wage Base Limit Is.

The steps below will guide you on withholding tax.

We Recommend That You Use The New Payroll Deductions Tables In This Guide For Withholding Starting With The First Payroll In January 2024.

Images References :

Source: www.taxuni.com

Source: www.taxuni.com

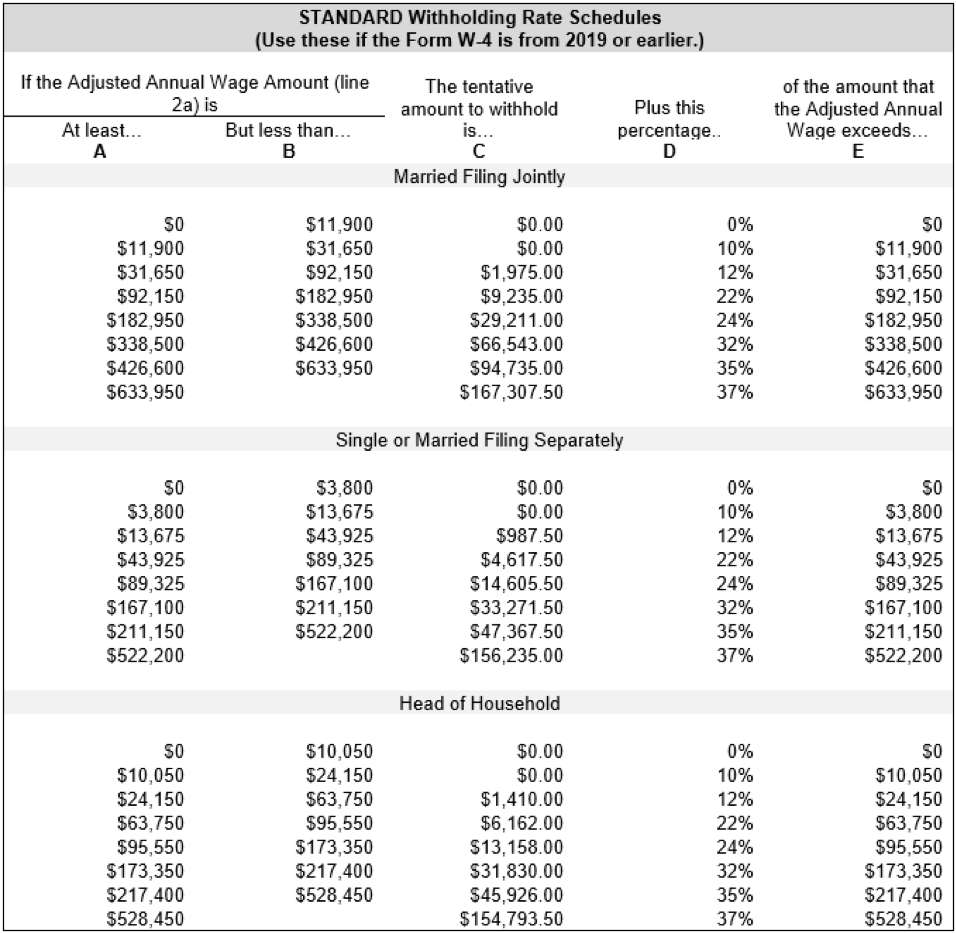

Federal Withholding Tables 2024 Federal Tax, Based on the revised withholding tax table of bir, since this taxable income is above ₱20,833 and below ₱33,332, we subtract ₱20,833 from ₱28,175 to get ₱7,342. Page last reviewed or updated:

Source: www.pinterest.com

Source: www.pinterest.com

Revised withholding tax table for compensation Withholding tax table, Tax table, Tax, The service posted the draft version of. Social security and medicare tax for 2024.

Source: governmentph.com

Source: governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue, 2024 income tax withholding tables. If married filing jointly, enter combined amounts.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

Married Federal Tax Withholding Table Federal Withholding Tables 2021, It is given by the following formula: Stay informed about tax regulations and calculations in philippines in 2024.

[Solved] How to compute for the semimonthly withholding tax of a person who… Course Hero, Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your. The following are key aspects of federal income tax withholding that are unchanged in 2024:

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

Texas Withholding Tables Federal Withholding Tables 2021, The department has updated its wage withholding tax tables (employer and information agent guide) as well as the employee’s withholding and exemption. Based on the revised withholding tax table of bir, since this taxable income is above ₱20,833 and below ₱33,332, we subtract ₱20,833 from ₱28,175 to get ₱7,342.

Federal Tax Withholding Tables Monthly Awesome Home, Philippines tax calculator 2024 get started. Supplementary compensation includes payments to an employee in addition to the regular compensation such as commission, overtime pay, taxable retirement pay, taxable bonus.

Source: phheadline.blogspot.com

Source: phheadline.blogspot.com

Look BIR releases revised withholding tax table Philippines Daily Headlines, Based on the revised withholding tax table of bir, since this taxable income is above ₱20,833 and below ₱33,332, we subtract ₱20,833 from ₱28,175 to get ₱7,342. Enter your monthly salary, filing status and select a state for instant federal and state tax deductions for 2024

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, No withholding allowances on 2020. Based on the revised withholding tax table of bir, since this taxable income is above ₱20,833 and below ₱33,332, we subtract ₱20,833 from ₱28,175 to get ₱7,342.

![Federal withholding tax tables 2024 [Updated]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/steps-for-federal-withholding-calculation-image-us-en.png) Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Federal withholding tax tables 2024 [Updated], Here's a breakdown of the income tax brackets for 2023, which you will file in 2024: The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Updated For 2024 (And The Taxes You Do In 2025), Simply Enter Your Tax Information And Adjust Your.

We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in january 2024.

Page Last Reviewed Or Updated:

Second additional cpp contributions (cpp2)