Increase In Home Insurance Premiums 2024

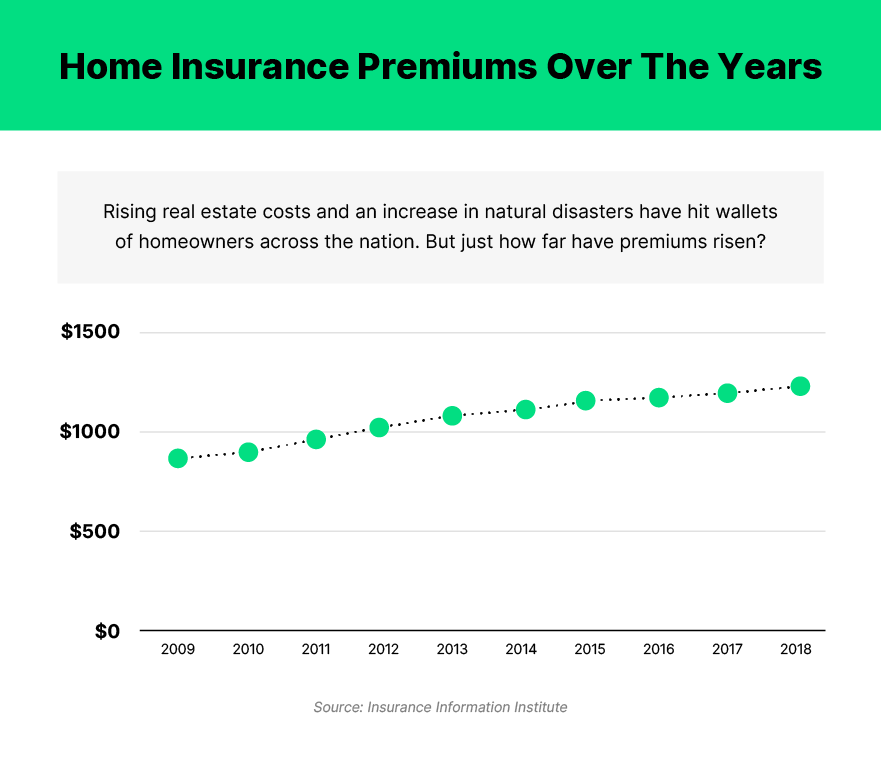

Increase In Home Insurance Premiums 2024. Home insurance rates are rising, influenced by climate catastrophes and inflation, leaving homeowners uncertain about future expenses. The good news is, consumer intelligence found there are signs prices rises could be slowing.

How to pay less for home. Home insurance may not get any cheaper for canadians in 2024.

On Average, Insurance Companies Sought To Raise Homeowners' Premiums By More Than 11% Last Year, According To S&Amp;P Global Market Intelligence.

From a decline in policy availability to rising premiums and increased deductibles, homeowners, carriers, and mortgage lenders have all faced significant challenges.

Homeowners Can Expect Rates To Continue To Climb In 2024 Due To Severe Weather Conditions Pushing Many Home.

In fact, home insurance has increased by an average of 21% across the u.s.

Here, We Present 2024 Home Insurance Trends, With Predictions About What The Future Holds For The Industry!.

Images References :

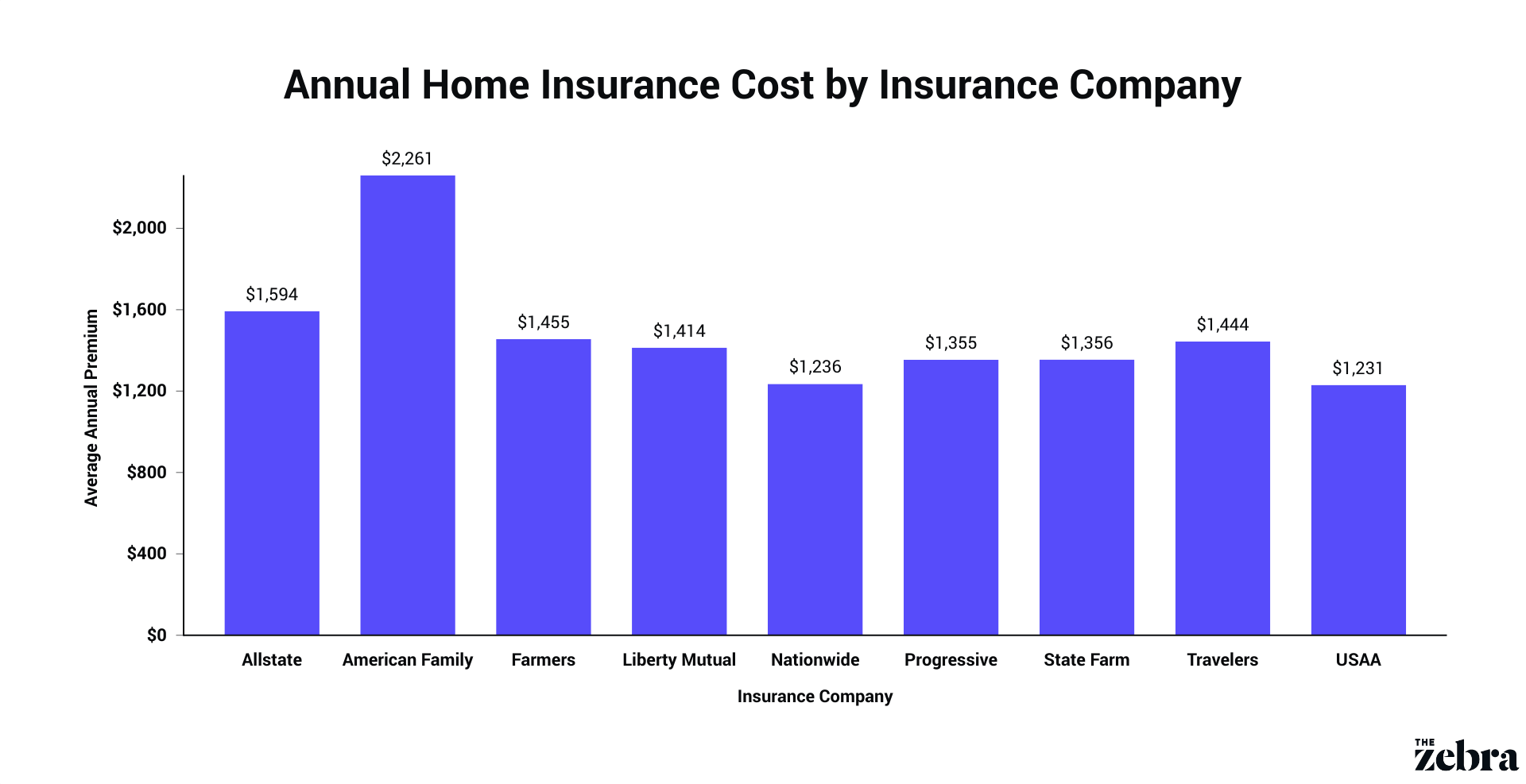

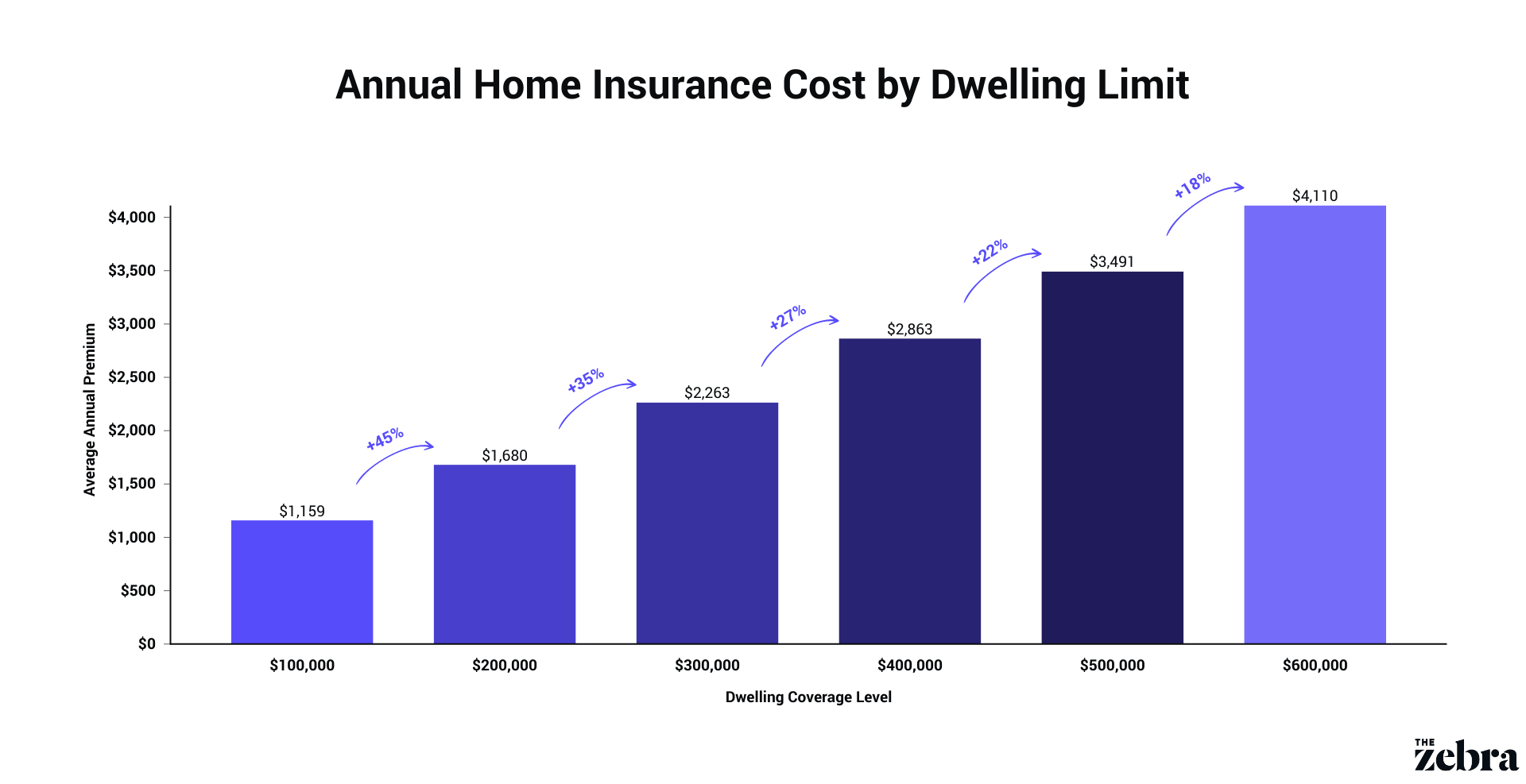

Source: www.thezebra.com

Source: www.thezebra.com

How Much Does Home Insurance Cost on Average? The Zebra, In the three months to. Jaclyn allen , joe vaccarelli.

Source: www.thezebra.com

Source: www.thezebra.com

How Much Does Home Insurance Cost on Average? The Zebra, Homeowners’ insurance carriers/providers face continuing challenges in projecting loss costs and. — home insurance rates continue to.

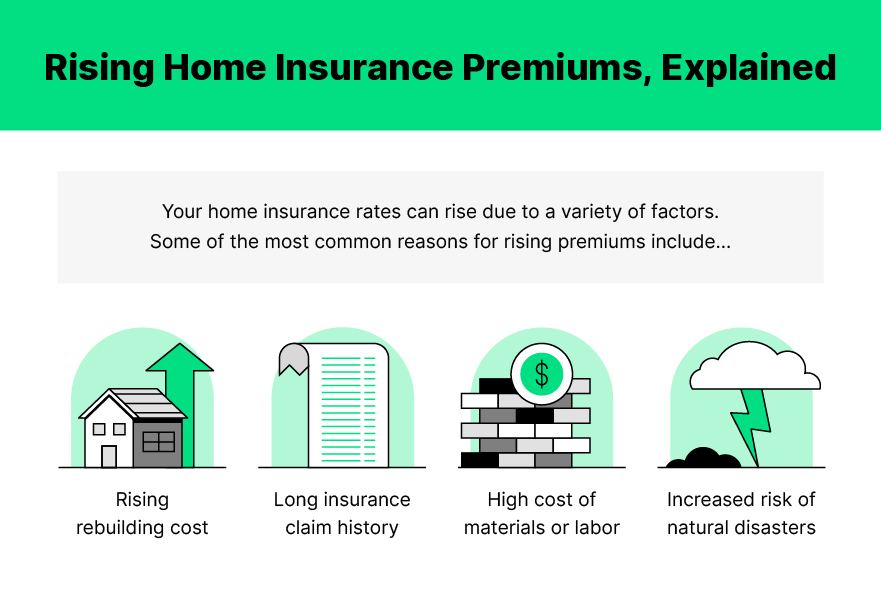

Source: www.hippo.com

Source: www.hippo.com

Learn Why Your Home Insurance Went Up Hippo, What's next for home insurance prices? Unfortunately, home insurance rates will continue to soar in 2024, according to insurify’s analysis.

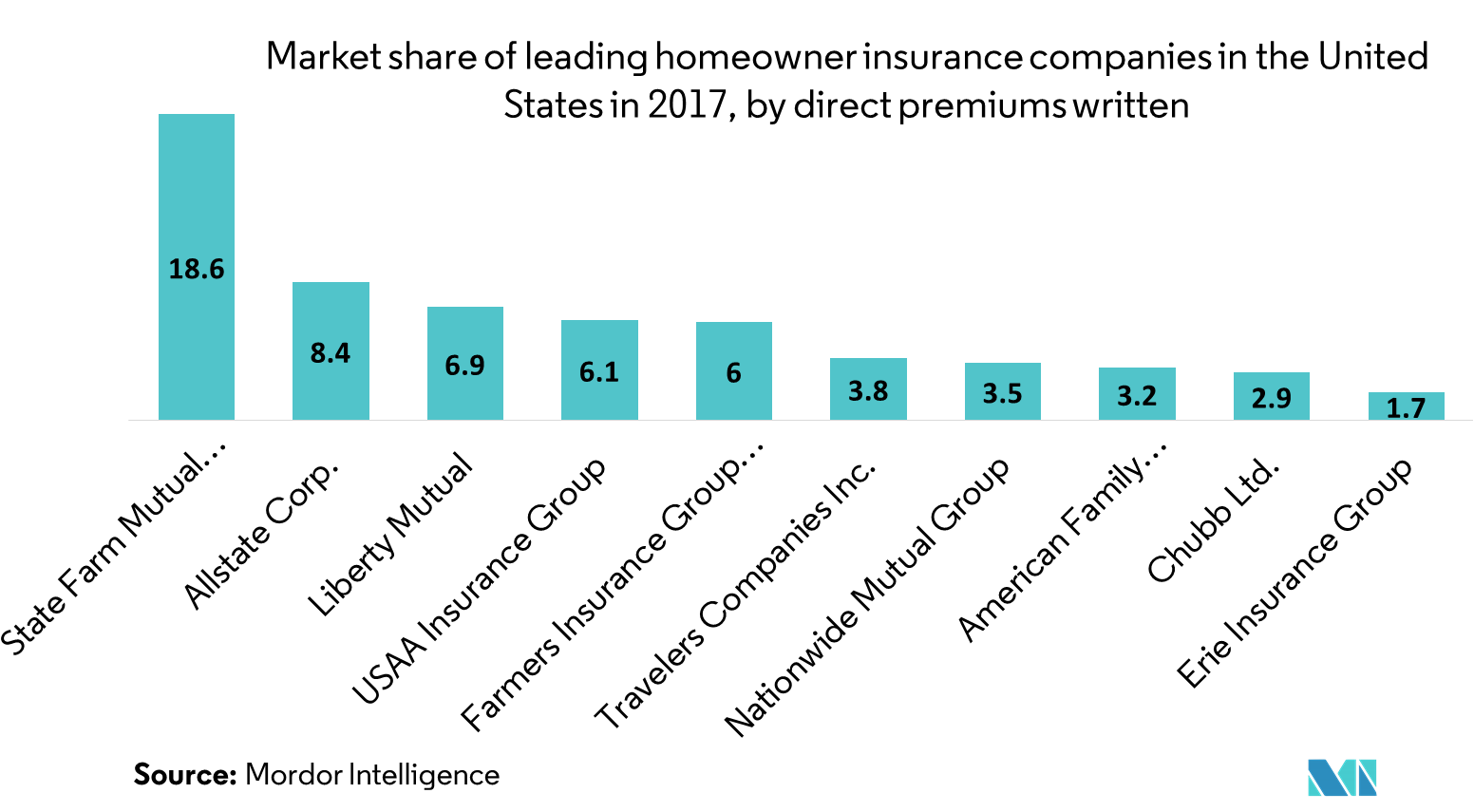

Source: www.mordorintelligence.com

Source: www.mordorintelligence.com

US Homeowners Insurance Market Industry Trends, Share & Overview, The home insurance market is crumbling in new orleans, leaving alfredo herrera with few options for coverage — and. Almost everyone who had home insurance in 2023 ended the year paying more.

Source: www.mordorintelligence.com

Source: www.mordorintelligence.com

US Homeowner's Insurance Market Growth, Trends, and Forecast (2019 2024), Annual home premiums are expected to jump by an average of 6% nationally, from $2,377. Canberra homeowner rachel sirr's home insurance premium increased by $70 per month.

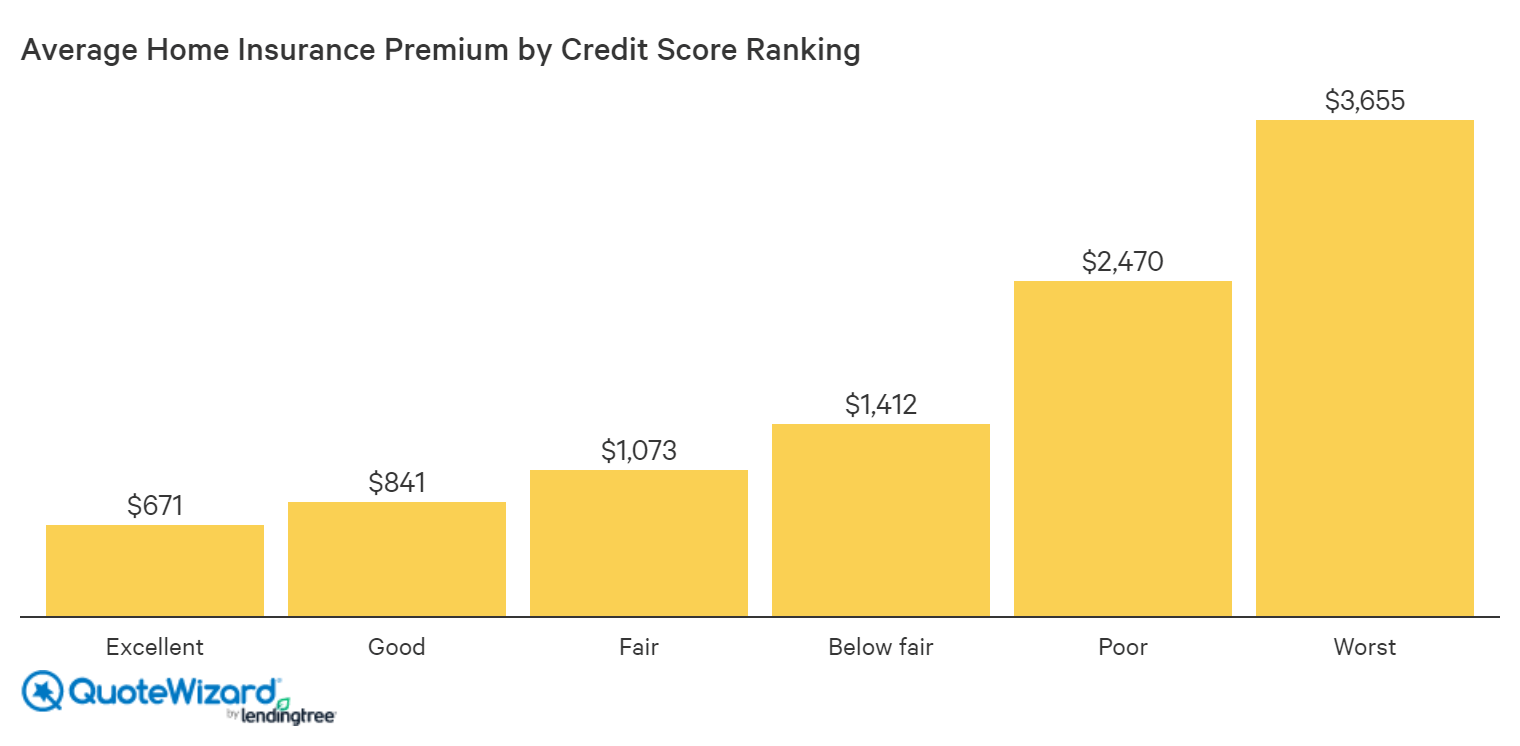

Source: quotewizard.com

Source: quotewizard.com

Home Insurance Cost Factors How Your Rate is Decided QuoteWizard, Homeowners’ insurance carriers/providers face continuing challenges in projecting loss costs and. Unfortunately, home insurance rates will continue to soar in 2024, according to insurify’s analysis.

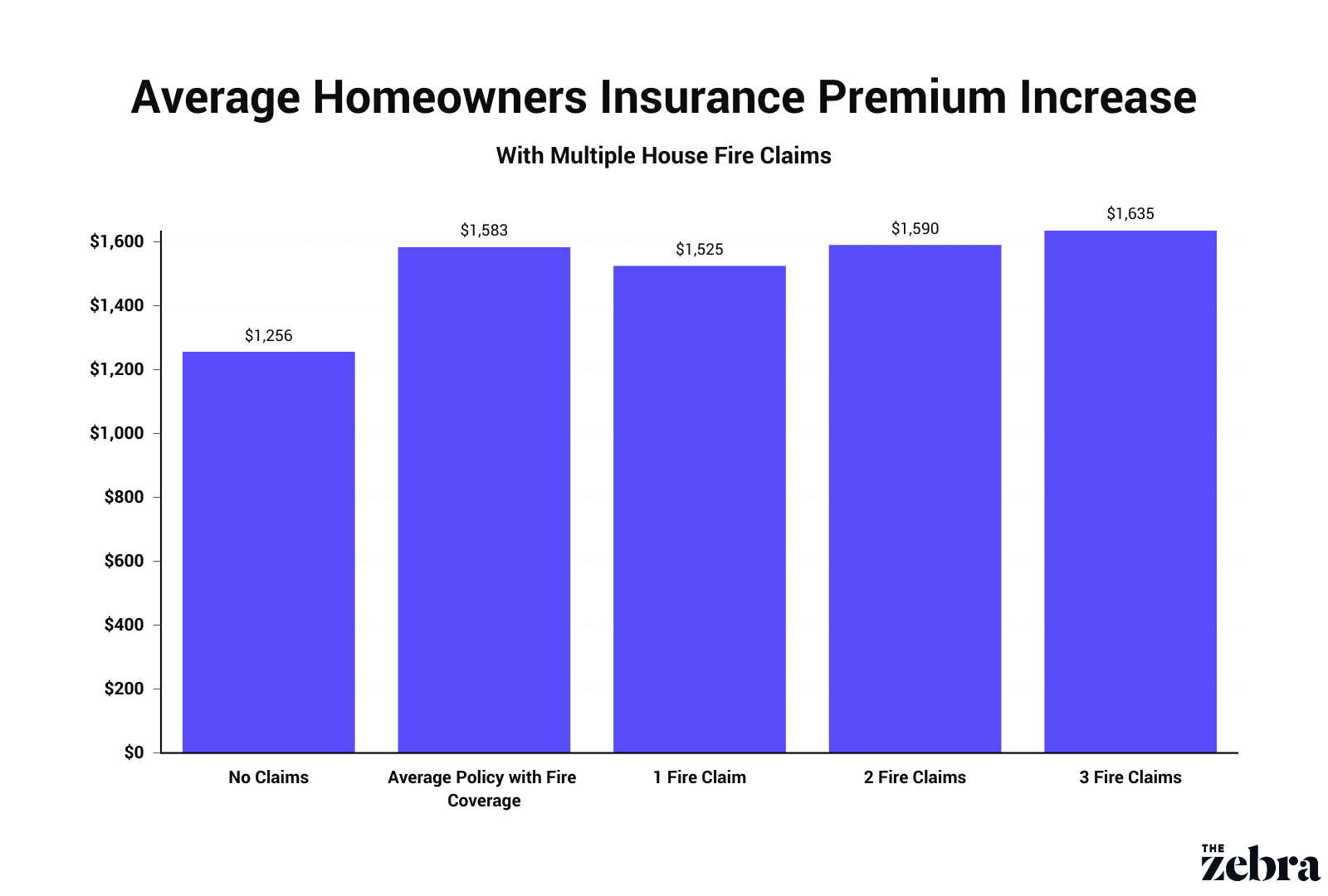

Source: www.thezebra.com

Source: www.thezebra.com

House Fire Statistics in 2023 The Zebra, What's next for home insurance prices? Posted at 6:06 pm, oct 30, 2023.

Source: www.hippo.com

Source: www.hippo.com

Learn Why Your Home Insurance Went Up Hippo, The good news is, consumer intelligence found there are signs prices rises could be slowing. Canberra homeowner rachel sirr's home insurance premium increased by $70 per month.

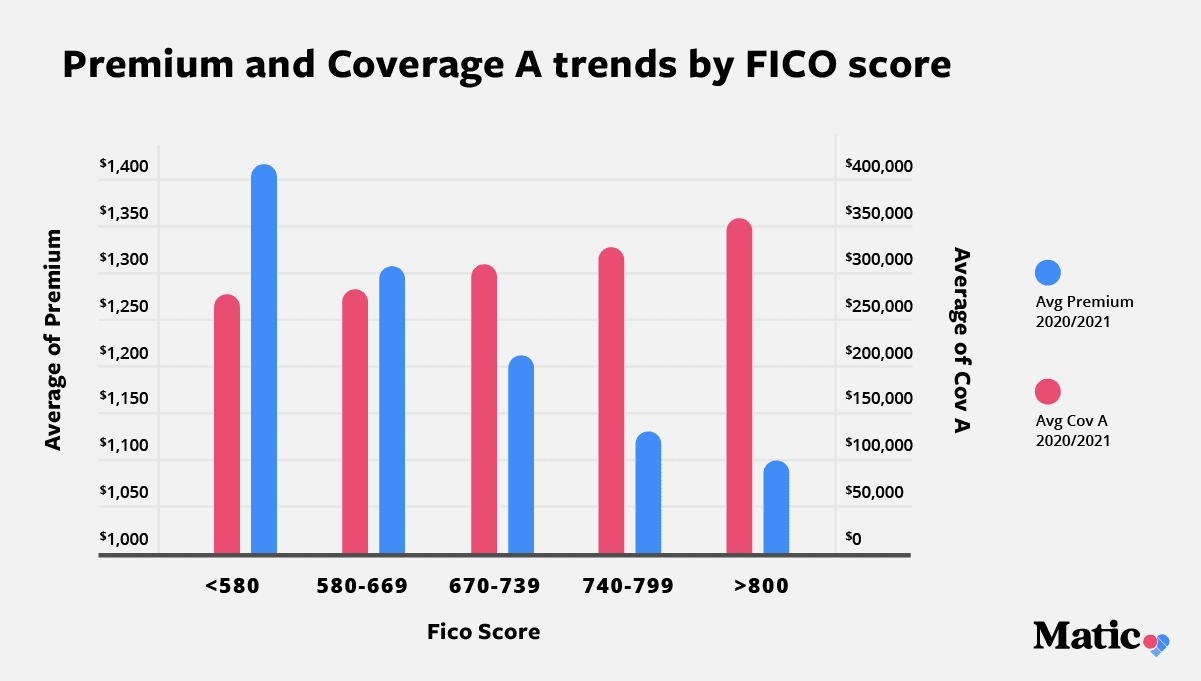

Source: matic.com

Source: matic.com

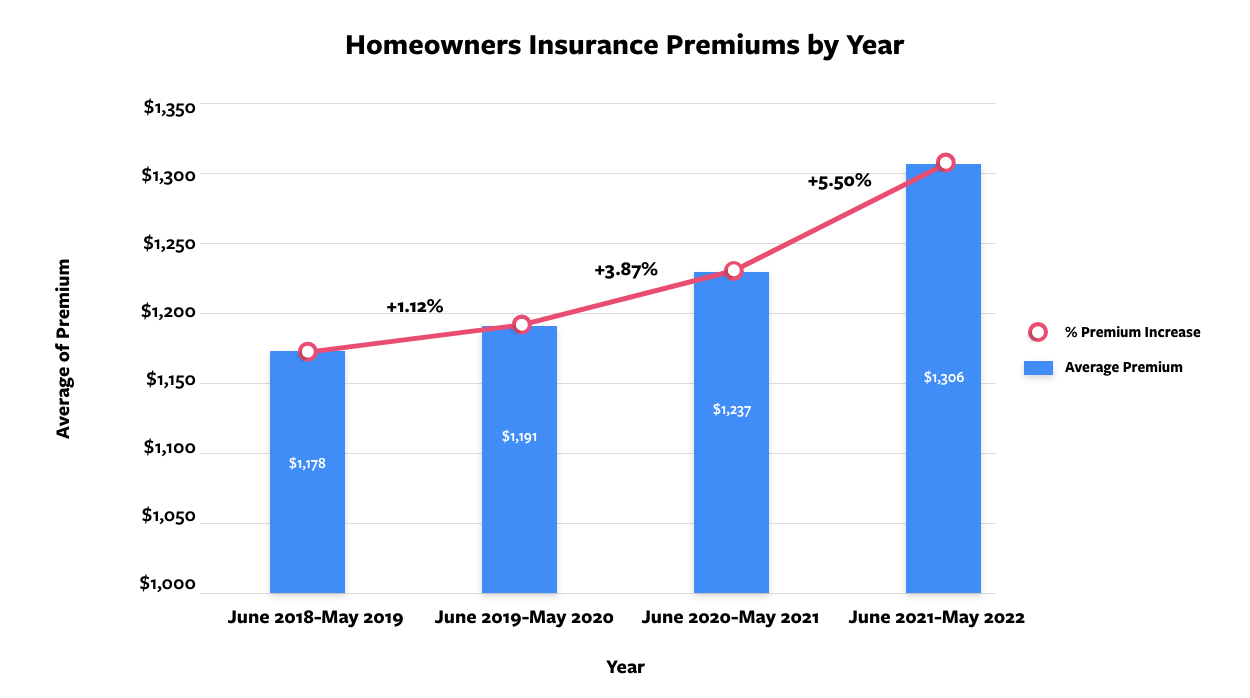

Report Impact of Homeowners Insurance Premium Increases Matic, Home insurance rate predictions for 2024. How to pay less for home.

Source: matic.com

Source: matic.com

Study Inflation, Climate Change Impact Home Insurance Premiums Matic, Home insurance is set for a big renovation in 2024. Posted tue 25 jul 2023 at 1:45pm.

The Answer To That Question, In Addition To Trends In Home Repair Costs, Could Determine How Much Premiums Rise In 2024 And Beyond.

Posted tue 25 jul 2023 at 1:45pm.

Insurance Premiums Are Rising Faster Than Inflation, Squeezing Homeowners, Drivers And Private Health Customers, Even As Some Of Australia’s Biggest Insurers.

On average, insurance companies sought to raise homeowners’ premiums by more than 11% last year, according to s&p global market intelligence.